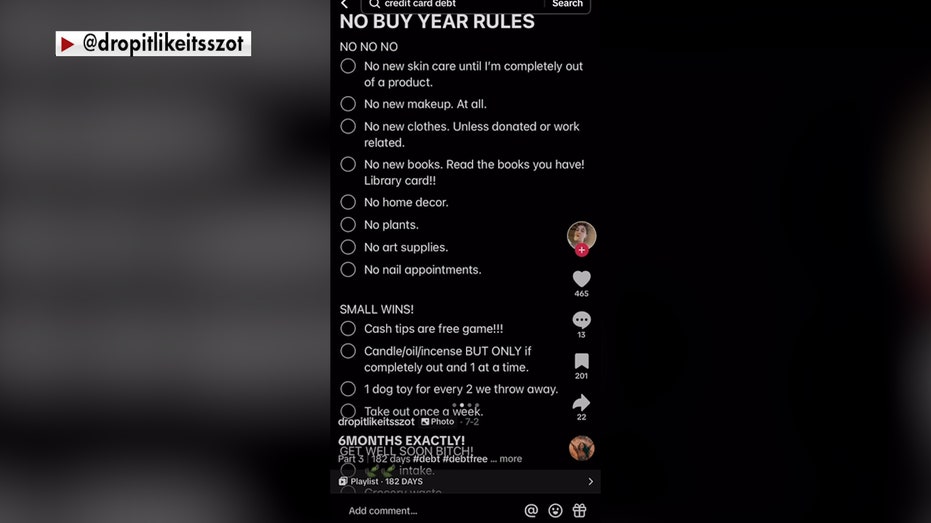

A Tiktok trend is encouraging people to save more money. It’s called the ‘no-buy year.’ The rules are simple. Make a list of the non-essential items you will not spend money on for a set length of time and stick to it.

Many people start at the beginning of the year, but some try the challenge for just a month since it could be difficult for a whole year. Some are paying off tens of thousands of dollars in debt.

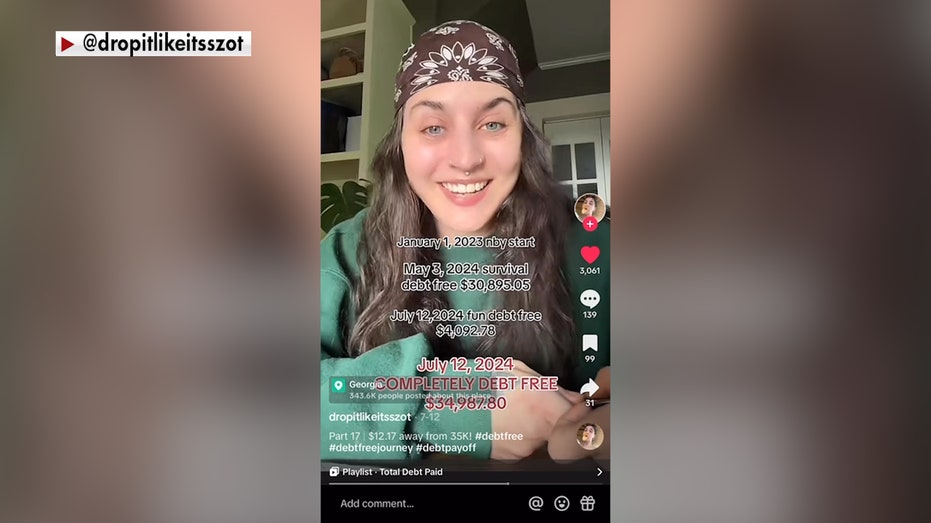

“I’ve been on a debt-free, no-buy year journey since January 1, 2023. On May 3, 2024, 488 days later, I’ve paid off all of my survival debt, which was $30,895.05,” said no-buy year participant Angela Szot.

TIRED OF HAVING AN ‘INFLATION HANGOVER?’ TRY THESE FIVE HACKS TO SAVE MONEY

Szot was fed up with living paycheck to paycheck and putting her monthly bills on credit cards, so she tackled the trend that’s taking over Tiktok.

The rules are personal for everyone. Szot stopped spending money on new beauty products and services, home goods and crafts.

That’s not all the debt Szot has paid off. She also paid her “fun debt,” which totaled $4,092.78, leading to a grand total of nearly $35,000 gone from her credit cards.

GEN Z LEANS ON CREDIT MORE THAN MILLENNIALS DID AND RACKING UP MORE DEBT

“But I could have small wins. You have to treat yourself. My cash tips from my job are free game. I only get like $10 to $20 every two weeks, but I can buy 2 or 3 coffees with that,” said Szot.

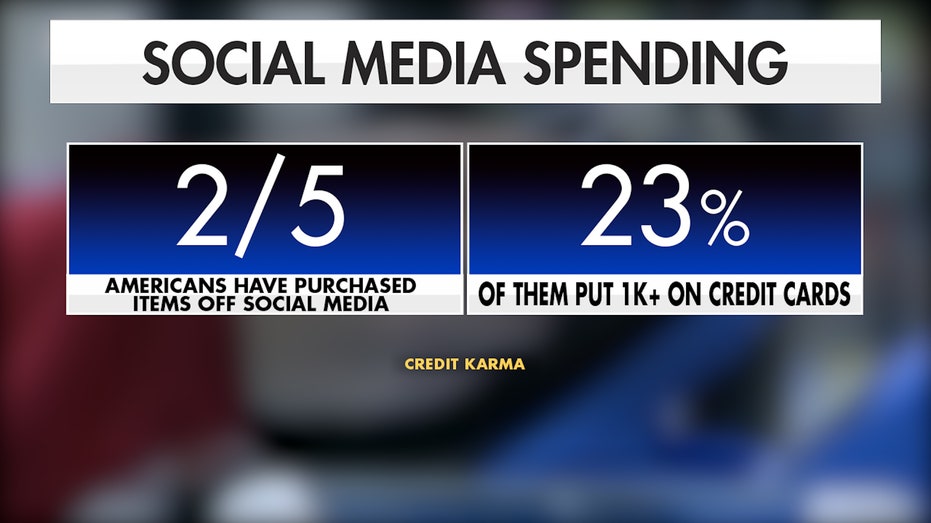

“Consumer spending has remained really strong despite sustained inflation and record high interest rates. And this is especially the case for young people who claim that their spending has gotten so out of control that they form shopping addictions, often developed during the pandemic and driven really largely by social media,” said Credit Karma Consumer Financial Advocate, Courtney Alev.

GEN Z LEAST FINANCIALLY CONFIDENT GENERATION, SURVEY SAYS

Some people post on social media to hold themselves accountable during the challenge, but it got a lot of others into money trouble to begin with.

According to Credit Karma, roughly 2 in 5 Americans have purchased products on social media in the past year, and nearly a quarter of them have charged $1,000 or more on credit cards.

“It’s hard to really adjust your relationship with money. But by making this focused effort, whether it’s a week, a month or a year, to really examine where every dollar you have is going, this will naturally make you way more aware of where your money is going,” said Alev.

All that awareness and focus is helping Szot fulfill her dream of buying a home.

“You can change your life. I did. I’m a 32-year-old baker from Atlanta, Georgia, who makes 45k a year. I don’t have family. I did this by myself,” said Szot.

Szot suggests anyone who wants to try the trend should buy a notebook, to track progress.

Read the full article here