The pattern shows up in many areas of the country: development activity fills in between two metropolitan areas, typically along one or more highways that connect them. Orlando to Tampa along I-4 is another prime example, and there are dozens more around the country.

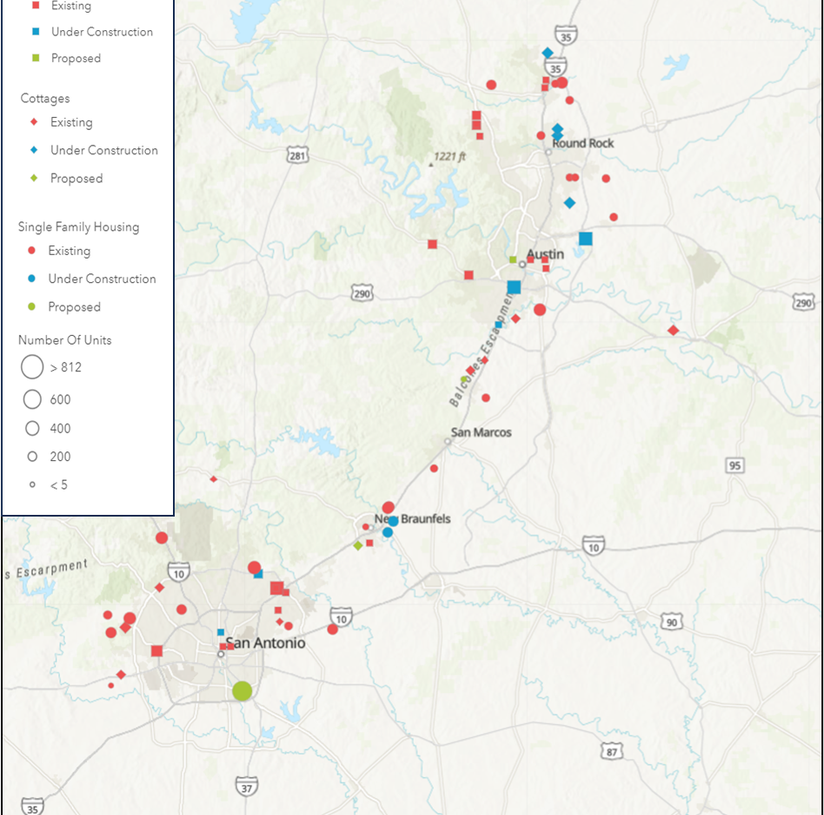

From New Braunfels to San Marcos, as well as closer-in suburbs, the stretch between Austin and San Antonio is starting to fill in, providing young families and singles with an alternative to home ownership. The map below, featuring data from CoStar and supplemented by original research by Hunter Housing Economics, shows the built-to rent (”BTR”) units that have already been built, as well as those that are under construction and proposed in that stretch. BTR housing fills the heretofore unserved set of households who want a suburban place with a yard or some small patch of private outdoor space, but who cannot afford (or choose not to buy) a single-family home.

A large proportion of the BTR developments now completing units in areas like San Marcos and New Braunfels are single-family detached homes, and as one gets closer to the larger cities of Austin or San Antonio, one finds more townhomes and more of the “horizontal apartment” style (also referred to by the more palatable “cottages”), which gives tenants a better living experience than typical apartments, in that they offer a ground-floor entry and usually a fully-detached home, with windows on four sides, and a small backyard. This type of rental product is just starting to take off, being met by strong demand from singles, couples, retirees, and people who own dogs. (The advantage for dog owners is that they can let the dog out the back door instead of putting them on a leash and walking them down corridors and/or elevators to get outside).

Like the cottages, built-to-rent townhomes tend to get developed closer to the major cities. Townhomes typically offer more square footage, but also more shared walls, and are commonly found in “infill” types of locations. There is evidence of market support farther away from the major metros, as long as they are in good proximity to schools and shopping. Areas south of Austin like Buda and Kyle are experiencing strong population and household growth, amplified by a continued migration of Californians looking for a lower-tax environment and lower cost of living in general. New schools are popping up there, which appeal to the new residents. Rent concessions that has been in effect a year back are now being removed, boosting effective rents. Family demand is under-served in this region. Consequently, rents on new townhomes or duplexes in this area can be as high as $2,600 per month for 3-bedroom units and $3,000 per month for 4-bedroom units, if they include well thought-out floorplans and better features and amenities than the existing homes in the area. The cost to own similar units is close to $3,200 per month.

There is a significant rent premium over individually-owned rental homes, particularly homes that are not in a master-planned community. Research by Hunter

Housing Economics this year quantified the premium in the southern U.S. as $265 per month. On a percentage basis, renters are willing to pay 13.3% more for a newly built rental townhome than one that is not new, according to the survey results. The premium over a rental apartment meanwhile came in at 24.3%.

In the area north of San Antonio, BTR projects such as Pradera, Village at Vickory Grove, Eschelon at Monterrey Village, and Springs at Alamo Ranch have performed well. Rents in this area can get up to $2,500 per month.

Another example of this pattern of “filling in” between major cities is in Florida, along the I-4 corridor between Tampa and Orlando. This map shows the built-for-rent

developments that already exist in Tampa, extending mostly northward right now. From the other direction, spilling out of Orlando, there have been some BTR projects in Kissimmee and St. Cloud, due south of Orlando, and also to the west, mostly near Interstate-4.

Built-to-rent development activity is slowing now, and we will certainly see a sharp reduction in BTR starts next year, due to a shortage of capital. Developers who are planning projects to enter the market in 2025/2026 are likely to find a smaller number of projects opening up around them. Some of our clients are getting into position to pick up what might emerge as “distressed” BTR projects next year, when it is expected that some investors who tied up land will find themselves financially unable to close on the purchase. The lack of capital in this space could represent an opportunity for well-capitalized investors to pick up a contract or otherwise get into a deal that is not currently available. Next year should be an interesting one for BTR investors and developers.

Read the full article here