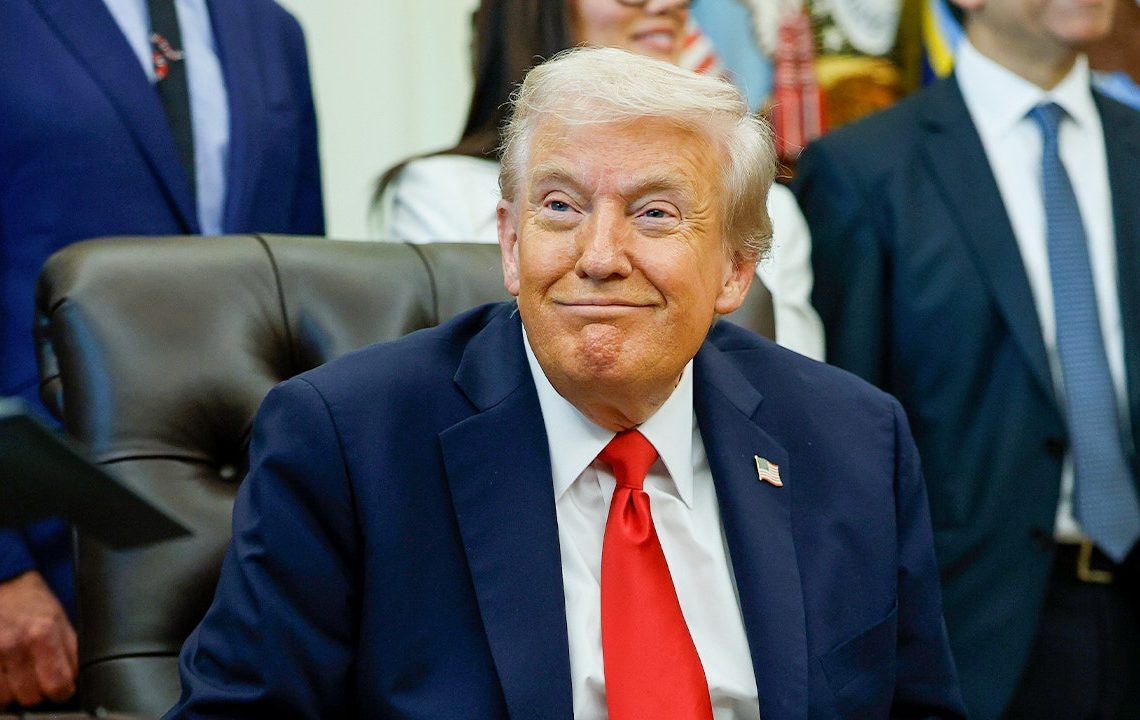

President Donald Trump is touting improvements in mortgage costs since he took office as he looks to address Americans’ concerns about affordability amid persistent inflation in the economy.

Trump spoke at a rally in Pennsylvania on Monday and blamed the Biden administration for high housing costs, saying that “America is winning again” because of his policies. The president also displayed a chart showing that annual total mortgage payments increased over $14,600 during former President Joe Biden’s term, while they have declined by more than $2,900 since Trump returned to the White House.

“We went down with our rates, they went up with their rates. So with us, you save $2,900 – almost $3,000. And with them, you go up. It costs you $15,000. You don’t hear that because the fake news doesn’t tell you that,” Trump said.

Realtor.com analyzed the president’s claim and found that it’s largely accurate for new homes, although median mortgage payments are over 80% higher than they were at the end of Trump’s first term even after accounting for the recent decreases.

POWELL SAYS RATE CUTS WON’T MAKE ‘MUCH OF A DIFFERENCE’ FOR STRUGGLING HOUSING SECTOR

A White House official told Realtor.com the chart is based on the median purchase price of newly built homes, with a 10% down payment and using the national average mortgage rate from Freddie Mac.

Realtor.com’s analysis yielded similar findings, though it noted some differences that could have arisen regarding how mortgage rates were averaged.

The outlet found that prices for existing homes yielded a similar increase in mortgage payments under Biden, with annual payments increasing about $14,600 over his term. Comparing that to savings on mortgage payments for existing homes under Trump’s second term yielded smaller savings of about $540 annually, or $45 per month.

HOME DELISTINGS SURGE AS SELLERS STRUGGLE TO GET THEIR PLACE

During Biden’s term, mortgage payments surged due to a combination of rising home prices and a jump in mortgage rates.

Prices for new homes rose over 20% from January 2021 to January 2025, while the average mortgage rate increased from 2.74% to 6.96% in that period, Realtor.com found.

Existing home prices rose even more dramatically, increasing by 48% from January 2021 to January 2025, when the price growth slowed to an average of about 2% this year.

THE MARKETS WHERE HOMEBUYERS MAY FINALLY GET SOME RELIEF IN 2026, REALTOR.COM SAYS

New home prices have trended lower since late 2022, while mortgage rates have eased to about 6.2% in recent weeks.

“Presidential terms are long, and their impact on the economy doesn’t necessarily start and stop exactly as the administrations change over, which can make it easy to use the data to make a favorable case, but harder to prove that credit is really due to the change in president,” said Realtor.com chief economist Danielle Hale.

Read the full article here