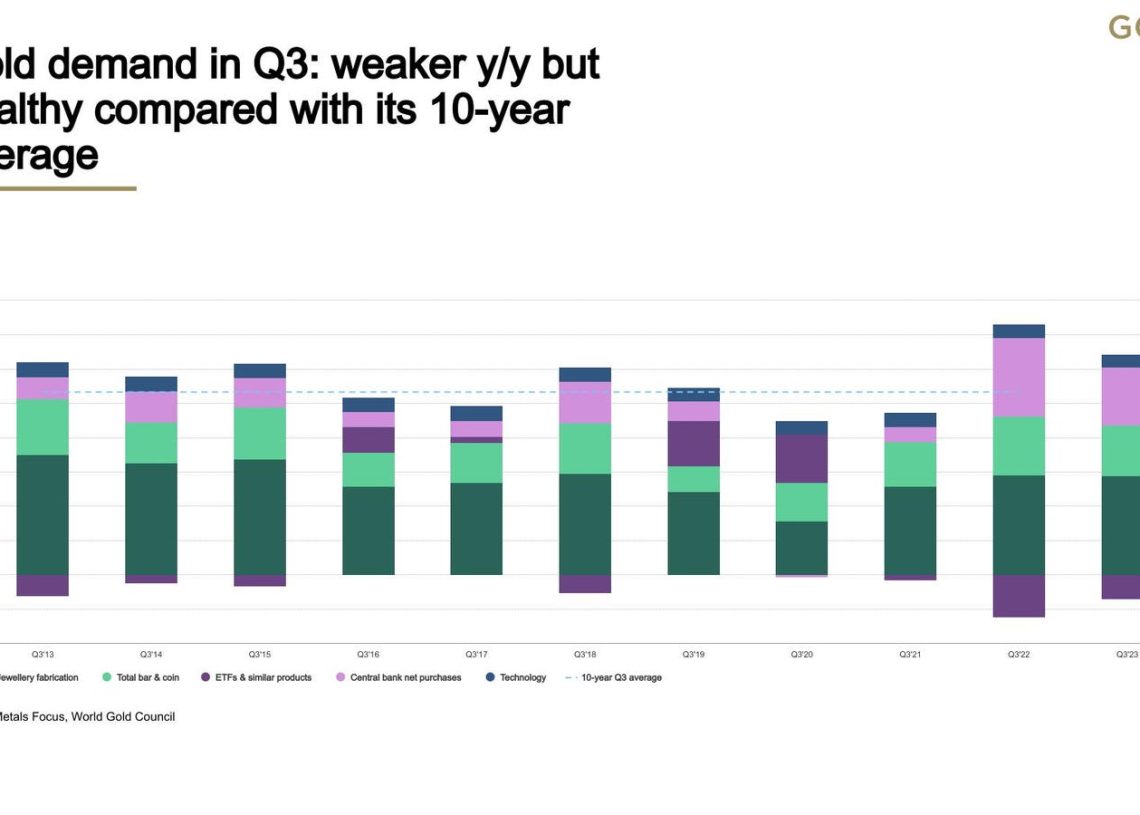

Global gold demand slipped year on year between July and September but still surpassed historical norms, according to the World Gold Council (WGC).

Total consumption (excluding over-the-counter (OTC) purchases) totalled 1,147 tonnes during the third quarter. This was down 6% from the corresponding 2022 period, but 8% above the five-year average.

However, including OTC buying and stock flows, demand was up 6% at 1,267 tonnes.

The WGC said that gold purchased made by central banks “maintained a historic pace but fell short [of the record set in the third quarter of 2022].”

It added that “jewellery demand softened slightly in the face of high gold prices, while the investment picture was mixed.”

Gold prices (as per the London Bullion Market Association’s (LBMA’s) afternoon benchmark) averaged $1,928.50 per ounce last quarter, the WGC noted. This was down 2% from quarter two’s record peaks but up 12% on an annual basis.

The council said that “several countries saw higher local gold prices due to currency weakness against the US dollar, including Japan, China and Turkey.”

Central Bank, Investment Demand Rises

Central bank purchasing was strong at 337 tonnes during quarter three, though this was down more than a quarter from the 459 tonnes purchased a year earlier. For the first nine months of 2023 purchases were up 14% at an all-time high of 800 tonnes.

The WGC said that “while there is a nucleus of committed regular buyers, the range of countries whose central banks have added to their reserves over recent quarters is broad-based.”

Investment demand was up 56% year on year during the third quarter, at 157 tonnes. However, this was much lower than the five-year average of 315 tonnes.

Gold-backed exchange-traded funds (ETFs) endured outflows of 139 tonnes in the quarter, though this was down from the 244-tonne outflow recorded a year earlier.

The council described investment demand as “mixed” in the last quarter, noting that bullion-backed ETFs “have now registered six successive quarters of negative demand.”

The organisation added that “bar and coin investment is broadly in line with [the first three quarters of 2023]” thanks to strong demand in the Middle East, Turkey and China.

Bar and coin investment dropped to 296 tonnes in quarter three, down 14%, although the WGC noted that this figure “remained firmly above the five-year quarterly average of 267 tonnes.”

Jewellery Sales Dip

Global gold jewellery demand dipped 4% between July and September, the WGC said, to 516 tonnes. However, this was still 4% above the five-year average.

The body noted that “the environment of high gold prices and economic uncertainty was a key driver of the [year on year] decline, particularly in some of the more price-sensitive markets in Asia and the Middle East.”

In Mainland China, gold jewellery demand dipped 6% to 154 tonnes last quarter, while in India it rose 6% to 156 tonnes.

While the WGC said that demand “has continued to hold up relatively well in spite of the very high price environment,” it commented that “risks to this sector remain, given the precarious economic scenario in many markets and continued pressure on consumers from the cost of living crisis.”

Elsewhere, the WGC said that “fragile consumer electronics demand continued to undermine volumes of gold used in technology.” Total technology demand dipped 3% in quarter three to 75 tonnes.

Consumption from the electronics sector dropped 4% to 61 tonnes, and dentistry demand fell 8% to just over 2 tonnes. Demand for other industrial applications rose 4% year on year to 12 tonnes.

Read the full article here