Millions of borrowers with existing student loans still have not made a payment since the bills resumed in October after a three-year hiatus, and some admit they are refusing to pay out of protest.

In an Intelligent.com survey conducted this month of 1,000 federal student loan borrowers, 25% said they had not made any payments at all, and 9% of those said they were holding off on paying their bills intentionally in an effort to pressure the government into canceling their debts.

Of the nearly 1 in 10 delinquent borrowers taking part in this “boycott” of student loan repayments, 44% said they believe their protest will lead to the cancellation of some federal student loan debt, and 28% think it is “likely” the boycott will convince the government to cancel all student loan debt, the survey found.

But even if no further debt cancellation comes from the boycott, most of the protesting borrowers believe their efforts will make an impact.

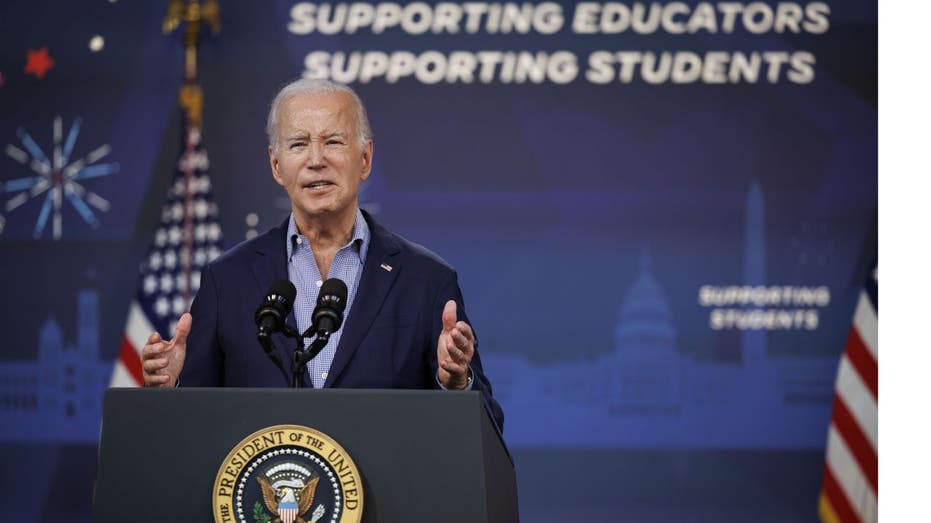

BIDEN ANNOUNCES PLAN TO BAIL OUT STUDENTS FOR LOAN DEBTS UNDER $12K

Eight-six percent told Intelligence.com it is “very” (45%) or “somewhat likely” (41%) that the boycott will draw attention to the student loan debt conversation. Sixty-four percent said they believe it is “highly” (32%) or “somewhat likely” (18%) that the boycott will help elect political candidates who believe in loan forgiveness.

Financial experts advise against missing student loan payments for any reason.

“Although the frustration behind the student loan boycott is understandable, it’s unlikely to lead to positive change,” DebtHammer founder and CEO Jake Hill told the outlet. “Instead, it will destroy the credit scores of those who choose to participate. This may not seem like a major issue in the short term, but failing to pay your student loans can make it more difficult to obtain funding for future purchases.”

BIDEN RENEWS ‘KEEP GOING’ CALL ON COLLEGE DEBT HANDOUTS

The vast majority, 69%, of borrowers who still have not resumed their loan payments said they have not paid the bills because they cannot afford to. Another 18% said they plan to hold off until September 2024 to resume paying because that is when more severe consequences for missing payments kick in.

Of the borrowers who have resumed making their payments, 94% told Intelligent that doing so has been financially challenging.

Many borrowers had high hopes that their loans would be wiped out by President Biden’s loan forgiveness plan to erase up to $20,000 in debt per borrower, but the Supreme Court struck it down last year.

Since then, the White House has announced other efforts to reduce student loan debt, including erasing $127 billion of debt owed by about 3.6 million borrowers.

FOX Business’ Megan Henney contributed to this report.

Read the full article here