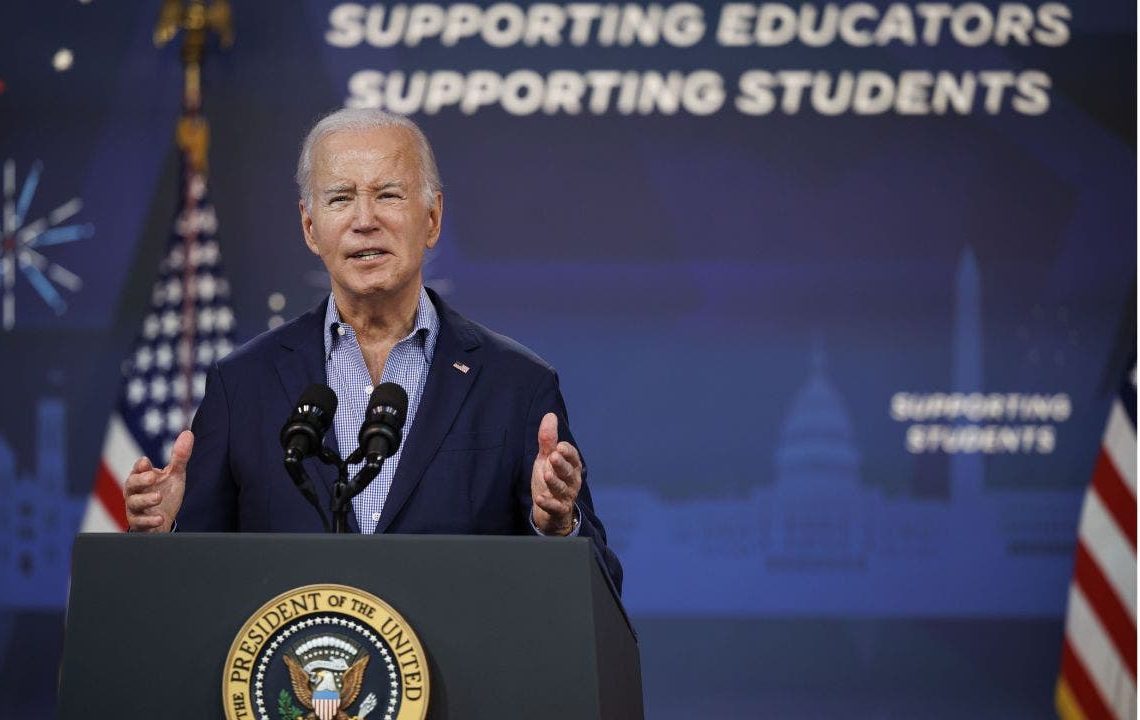

President Biden on Friday announced that some student loan borrowers enrolled in the Saving on Valuable Education (SAVE) plan will have their remaining debts zeroed out next month.

The plan, which Republicans say will see taxpayers foot the bill, applies to borrowers enrolled in SAVE who took out less than $12,000 in loans and have been in repayment for 10 years, Biden said in a statement. SAVE is an income-driven repayment (IDR) plan that calculates payments based on a borrower’s income and family size rather than their loan balance.

The administration did not detail how many individuals this would impact but insisted the action would particularly help community college borrowers, low-income borrowers and those struggling to repay their loans.

THE LAWLESSNESS OF BIDEN’S STUDENT LOAN BAILOUT WORKAROUNDS

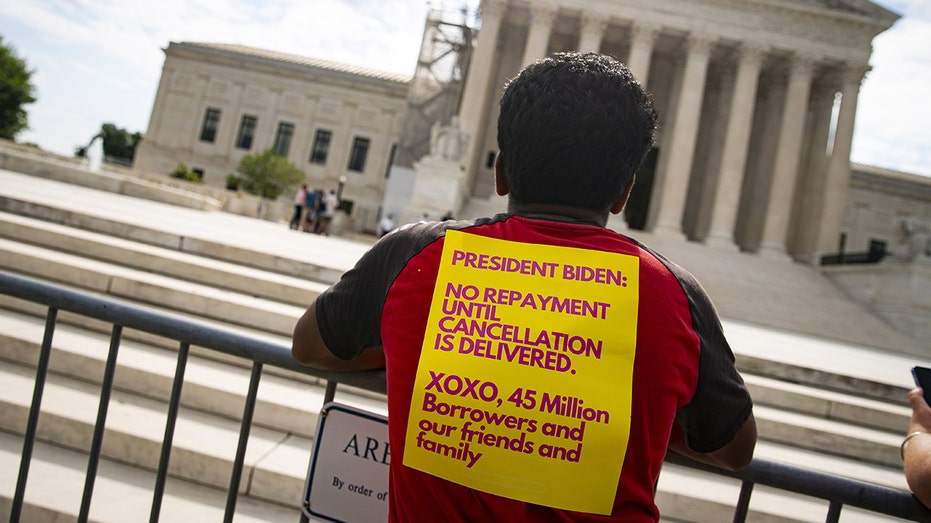

Around 3.6 million student loan borrowers have already seen their loans reduced to $0 monthly as part of the plan, which was originally announced last year in the wake of the Supreme Court striking down the White House’s plan to cancel $430 billion in student loan debt.

The latest phase of the SAVE plan was initially expected to come into effect in July, but Biden has instead brought the action forward to February. Already, 6.9 million borrowers are enrolled in the plan, he said.

“It’s part of our ongoing efforts to act as quickly as possible to give more borrowers breathing room so they can get out from under the burden of student loan debt, move on with their lives and pursue their dreams,” Biden said in a statement. “And, in the wake of the Supreme Court’s decision on our student debt relief plan, we are continuing to pursue an alternative path to deliver student debt relief to as many borrowers as possible, as quickly as possible.”

SUPREME COURT RULING ON BIDEN’S STUDENT DEBT HANDOUT IS MUCH BIGGER THAN YOU THINK

The announcement was panned by House Education Committee Chair Virginia Foxx, R-N.C., who described it as an election stunt.

“President Biden is downright desperate to buy votes before the election — so much so that he greenlights the Department of Education to dump even more kerosene on an already raging student debt fire,” Foxx said in a statement posted on X. “It would surprise no one if the Department relied on infants playing with abacuses to balance its books — it is a complete and utter disaster. It’s clear that the Biden administration needs a good old-fashioned dose of fiscal common sense — all it knows how to do is spend like a drunken sailor.”

According to the Penn Wharton budget model, SAVE will incur a net cost of $475 billion over the 10-year budget window.

Biden’s announcement was praised by Democrats, including Sen. Majority Leader Chuck Schumer, D-N.Y.

“This is good news for borrowers and for students wondering if college is within their reach,” Schumer wrote on X. “This is an important step in our movement to cancel meaningful student debt. I applaud the Biden admin for taking action.”

In July, another phase of the SAVE plan is expected to go into effect whereby payments on some undergraduate loans will be cut in half.

Qualifying borrowers with undergraduate loans will have their payments reduced from 10% to 5% of their discretionary income, while those who have undergraduate and graduate loans will pay a weighted average between 5% and 10% of their income, based upon the original principal balances of their loans, according to the White House.

Read the full article here