The Biden administration is continuing its mass student loan handouts as it announced another $6 billion that it would be giving to borrowers ahead of the 2024 election.

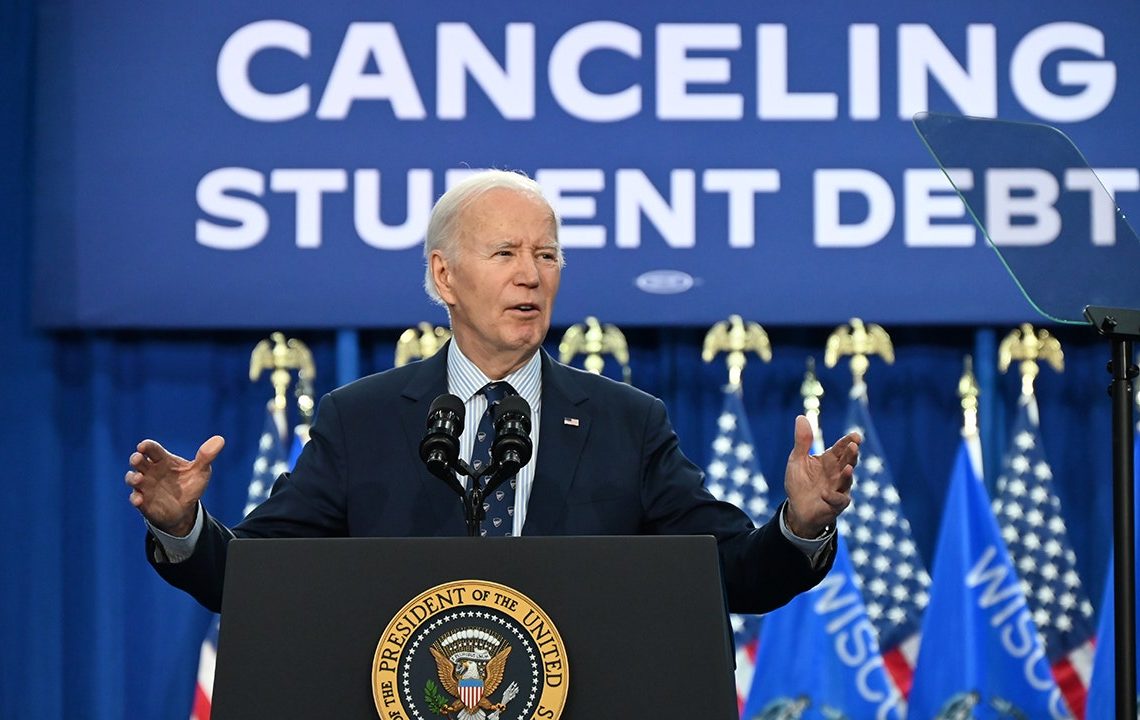

“Today, my Administration is approving $6.1 billion in student debt cancellation for 317,000 borrowers who attended the Art Institutes,” President Biden said Wednesday.

In the statement, the president and Education Secretary Miguel Cardona described the Art Institutes as “predatory” and said the new handouts would help students who were victims of their actions.

“This institution falsified data, knowingly misled students, and cheated borrowers into taking on mountains of debt without leading to promising career prospects at the end of their studies,” Biden said.

FOOD COSTS SOAR AS BIDEN HANDS OUT MASSIVE $7.4B FOR STUDENT LOANS

Biden’s newest handout lifts the number of total student loans forgiven by the administration to $160 billion, the White House said. This has impacted nearly 4.6 million borrowers.

“Over the last three years, my Administration has approved nearly $29 billion in debt relief for 1.6 million borrowers whose colleges took advantage of them, closed abruptly, or were covered by related court settlements, compared to just 53,500 borrowers who had ever gotten their debt cancelled through these types of actions before I took office,” Biden said Wednesday.

He continued: “Today’s announcement builds on all we’ve done to fix broken student loan programs and bring higher education more in reach. That includes: providing the largest increases to the maximum Pell Grant in over a decade; fixing Public Service Loan Forgiveness and Income Driven Repayment so borrowers get the relief they are entitled to under the law, launching the SAVE Plan — the most affordable repayment plan ever, and pursuing new plans that would cancel student debt for more than 30 million Americans when combined with everything we’ve done so far.”

BIDEN’S LATEST STUDENT LOAN HANDOUTS COULD COST AS MUCH AS $750B

Biden also renewed his vow not to stop handing out money to borrowers and make college more affordable to more students: “We will never stop fighting to deliver relief to borrowers, hold bad actors accountable, and bring the promise of college to more Americans.”

In Wednesday’s announcement, Cardona said the Biden administration was working with various states to pursue legal action against greedy schools.

“For more than a decade, hundreds of thousands of hopeful students borrowed billions to attend The Art Institutes and got little but lies in return. That ends today — thanks to the Biden-Harris Administration’s work with the attorneys general offices of Iowa, Massachusetts, and Pennsylvania,” said Cardona. “We must continue to protect borrowers from predatory institutions — and work toward a higher education system that is affordable to students and taxpayers.”

Federal Student Aid Chief Operating Officer Richard Cordray, who operates under the Department of Education, similarly said the administration was dedicated to restoring borrowers’ trust in educational institutions.

“The Art Institutes preyed on the hopes of students attempting to better their lives through education,” said Federal Student Aid Chief Operating Officer Richard Cordray. “We cannot replace the time stolen from these students, but we can lift the burden of their debt. We remain committed to working with our federal and state partners to protect borrowers.”

The relief will be automatically applied to those who qualify, the administration said.

It comes as students at colleges and universities across the U.S. are forming encampments and marches to protest Israel’s war with Hamas in Gaza.

Read the full article here