Bilt, a membership program centered on rewarding consumers for everyday spending, is rolling out a new lineup of credit cards Wednesday. They are not only designed to increase how much members can earn on housing, but they also offer a 10% APR for the first year to help with growing affordability for consumers.

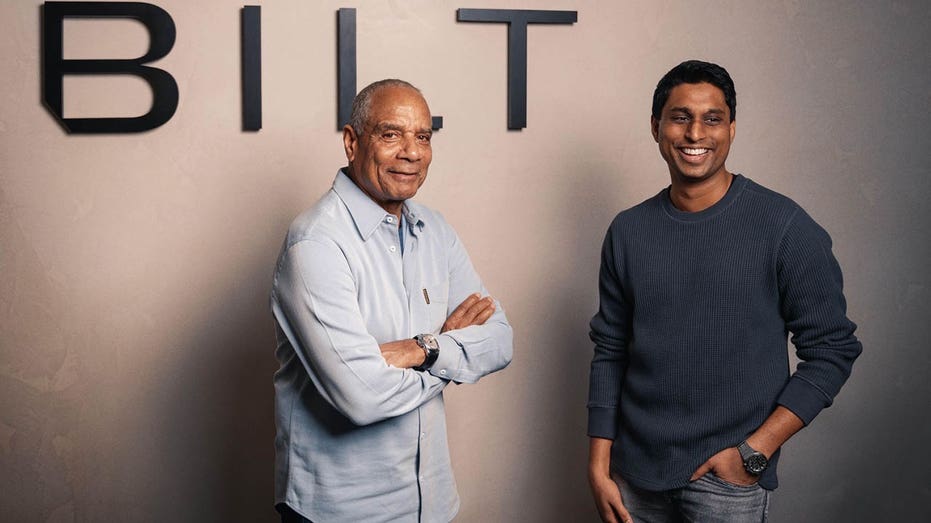

Bilt 2.0 is a revamped version of the company’s co-branded card program. This time, there will be three credit cards, ranging from a no-annual-fee option to a $495 premium card. One of the key things that sets them apart, according to CEO Ankur Jain, is that they are the first credit cards on the market that allow users to pay their rent or mortgage payment with no transaction fee.

Users will continue to earn rewards for every on-time rent or mortgage payment, which is part of Jain’s mission to make homeownership more attainable, especially at a time when many Americans are struggling to enter the market.

But with Bilt 2.0, members don’t earn a flat amount of points on housing payments. Instead, everyday spending determines how many points they can earn on rent or mortgage payments. In other words, the more people use the card, the more points they can unlock on rent and mortgage payments.

HERE’S HOW YOU CAN EARN POINTS WHEN PURCHASING A HOME

On top of rewarding consumers for everyday purchases, card users will simultaneously get 4% back in Bilt Cash on everyday spending, which can be used dollar for dollar. Earning points off everyday purchases and cash back is “unheard of in the market,” he said, underscoring why the company’s card can be seen as competitive in the current market.

YOUR NEXT WALGREENS TRIP MAY NOT COST YOU AS MUCH. HERE’S WHY.

Bilt Cash is a new rewards currency inside Bilt’s ecosystem. Cardholders earn Bilt Cash through everyday spending, which can be used for monthly credits at restaurants, hotels and rideshare services or to unlock additional points on rent or mortgage payments.

For housing payments, every $30 in Bilt Cash earned, cardholders can unlock 1,000 Bilt Points on rent or mortgage payments, even across multiple homes. For example, a renter paying $3,000 a month with $60 in Bilt Cash would earn 2,000 points on that payment, with no transaction fee.

In light of the bipartisan calls for affordability, Jain said all cardholders will also get 10% APR on all new purchases for the first year.

On Friday, President Donald Trump declared that he wants to impose a 10% cap on credit card interest rates for one year starting on Jan. 20, saying he wants to prevent consumers from being “ripped off” by credit card issuers with interest rates that may exceed 20% for some borrowers. His proposal follows the introduction of a bill last year by Sens. Bernie Sanders, I-Vt., and Josh Hawley, R-Mo., that would cap credit card APRs at 10%.

“We’ve always been hyper-focused on ensuring the American consumer wins. We offer free credit reporting, points on down payments, points on student loans. We want to set people up for success and this allows people for the next 12 months to have a balance that is helpful,” Jain said.

BILT REWARDS LAUNCHES NEW PROGRAM TO HELP WITH STUDENT DEBT

Bilt has consistently emphasized that members do not need to be cardholders to be part of its rewards program, but the cards are designed to deepen engagement within its broader loyalty ecosystem.

Current cardholders have to choose their new Bilt card by Jan. 30, 2026. They’ll keep the same card number and their subscriptions and autopay will continue as normal. The card will automatically update in Apple Pay and Google Pay as well.

Here are the cards:

Bilt Blue Card: no annual fee

- 1X points on everyday spend

- 4% back in Bilt Cash on everyday spend

- $100 in Bilt Cash on account opening

- Earn both Bilt Points and Bilt Cash with no annual fee and no foreign transaction fees

Bilt Obsidian Card: $95 annual fee

- 3X points on dining or grocery (grocery up to $25K/year), 2X on travel, 1X on all other everyday spend

- 4% back in Bilt Cash on everyday spend

- $100 in annual Bilt Travel Hotel credits

- $200 in Bilt Cash on approval

- Premium benefits designed for everyday value, including Trip Delay Insurance2, no foreign transaction fees

Bilt Palladium Card: $495 annual fee

- 2X points on everyday spend

- 4% back in Bilt Cash on everyday spend

- First-ever, limited-time 50,000-point sign-up bonus + Gold Status (after qualifying spend)

- $300 in additional Bilt Cash on account opening

- $600 in annual credits ($400 Bilt Travel Hotel credits + $200 in Bilt Cash)

- Additional premium benefits, including Priority Pass access, purchase protection, authorized users

Read the full article here