An earlier malignant superpower the U.S. faced down — the Soviet Union— lasted 74 years before its 1991 collapse. America’s current principal threat, China, is now in its 74th year as well.

But unlike the U.S.S.R., China seems in no danger of collapsing. Yet China is grappling with problems that are eroding it from within, and which could be turning the present and dangerous Washington-Beijing dynamic in favor of the U.S.

Such an approach towards China is needed. The U.S. has a tendency, as it did with the Soviet Union, to focus on its adversary’s strengths. But examining weaknesses is also instructive.

“China is weighed down by unfavorable demographics, growing and potentially crippling water shortages, and crushing youth unemployment. ”

What are China’s weaknesses? For starters, the perception that China’s economy is an unstoppable juggernaut destined to overtake the United States is questionable. According to World Bank data, China’s economic growth has been trending lower for a generation now; current growth rates have now slipped below America’s.

The U.S.-China Economic and Security Review Commission (USCC) published its annual report earlier this week, saying that China “may now be on the verge of its most serious economic crisis in 40 years.” The country is weighed down by unfavorable demographics, growing and potentially crippling water shortages, and crushing youth unemployment. The latter is so bad, in fact, that over the summer Beijing said that it would no longer publicly release data on the matter.

The U.S. has its own economic problems, of course. But “We don’t keep secrets and cover things up,” as former president Ronald Reagan said after the space shuttle Challenger disaster in 1986. “We do it all up front and in public. That’s the way freedom is, and we wouldn’t change it for a minute.”

Americans should realize that our openness — messy, and often nasty — actually conveys confidence and allows us to gradually work through our problems. China’s President Xi Jinping and Russian President Vladmir Putin are afraid of such openness.

There’s more. China’s stranglehold on global manufacturing is easing. According to MDS Transmodel data, China has lost, since 2016, 4% of the global exports for clothing, 11% for furniture, 7% for footwear and 13% for travel-related goods. Yes, the COVID pandemic played a role, but so did rising labor costs, which ceased to be dirt cheap long ago.

For these, and more valuable products, there is another dynamic: U.S., European and other companies have been reorienting supply chains away from China for years now, for economic and/or national security reasons. This adjustment has helped fuel temporary inflation, but the longer term impact of this is likely to be net positive.

Read: U.S. businesses operating in China are confused and worried. Here’s why.

And think the U.S. real estate market is troubled? China’s real estate sector, which represents about a quarter of that country’s economic activity, is in a deep and worsening slump. In August, the world’s most indebted property developer, Evergrande, filed for bankruptcy protection. Its largest developer overall, Country Garden

2007,

has been flirting with default for months. JPMorgan just hiked its 2023 Asia high-yield default rate forecast to 10% from 4.1%, a figure which drops to just 1% when Chinese property is excluded.

This popping of China’s massive real estate bubble, if it gets worse, could have a domino effect on other sectors of the Chinese economy, including construction, raw materials and more. It could also drag down Chinese banks, which are overexposed to the sector.

So it’s hard to disagree with the USCC’s analysis that China is facing its worst economic crisis in 40 years — in other words, since it began opening up and modernizing less than a decade after the death of Mao Tse-Tung, founder of the communist state. I don’t know how China will ultimately deal with all this, but I do know that Xi’s knee-jerk authoritarian tendency towards repression and information control won’t help.

“America’s economic problems make it harder to improve its position relative to China.”

But America’s own economic problems make it harder to improve its position relative to China.

Xi (and Putin) see the U.S. as a country in decline. The Israel-Hamas war, on top of the Russia-Ukraine stalemate, has accelerated their perception that the U.S. is stretched too thin strategically, a belief that presumably factors into Xi’s thinking on Taiwan.

Moreover, Americans are also living well beyond our means as a nation, and have been for quite some time. Last, but hardly least, our quarreling politicians, who until maybe 25 years ago saw their opponents in largely honorable terms — now do so in zero-sum, existential terms, much to the delight of Beijing and Moscow.

Xi has been working hard to undermine the foundations of global order that has been in place since the end of World War II in 1945. He continues to seek an alternative to the American-led financial and economic system created by the Bretton Woods Agreement. This includes ongoing efforts to shift the world away from the U.S. dollar

DX00,

as the world’s reserve currency and principal medium of global payments. Thomas J. Duesterberg, a senior fellow at the Hudson Institute, notes that “That system — in combination with Western dominance of high-tech industries allows the U.S. and allies to enforce sanctions” on international scofflaws like Russia, Iran and other rogue actors.

Americans must also recognize that China (and Russia) are ripping us apart with disinformation, which has always been a problem, but is now being turbocharged by artificial intelligence. “They are at war with us,” Ellen McCarthy, a former U.S. intelligence official, tells me, “and we don’t even know it.”

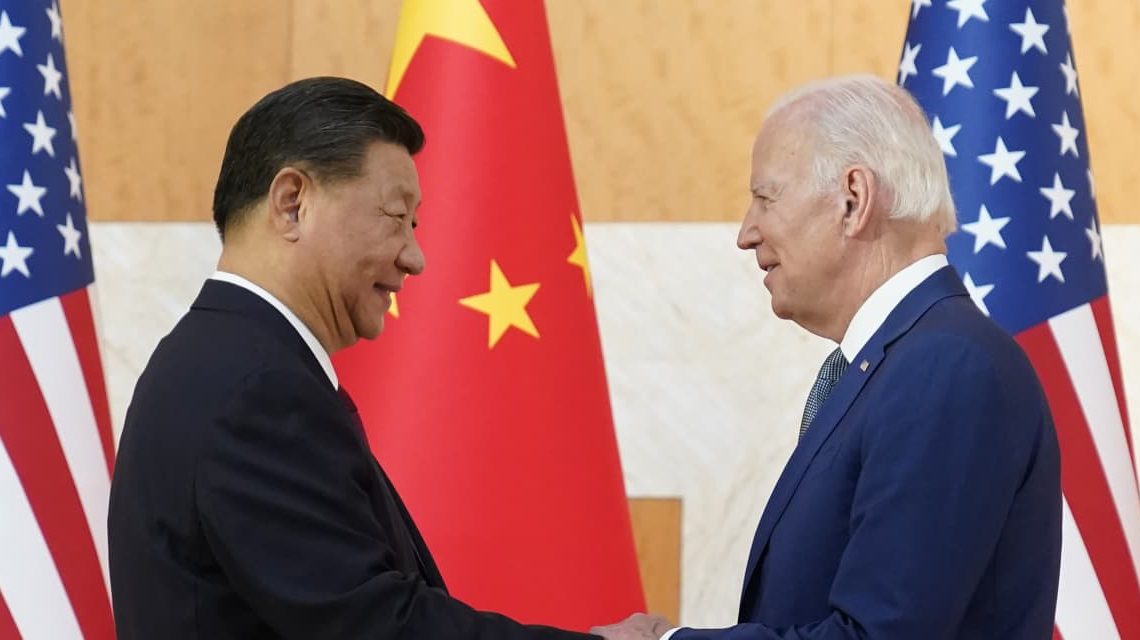

Read: How the Biden-Xi meeting in San Francisco could help prevent a world war

More: U.S., China move back from ‘brink’, says Ray Dalio, as ‘different type of war’ begins

Read the full article here