After Nvidia added $750 billion in value this year on the backs of surging AI chip demand, investors are quickly searching for the next trillion-dollar AI winner. AI is the best investment opportunity of our lifetimes, and although Apple (AAPL) has been relatively overlooked as an AI play, the tech giant could quickly become a force to be reckoned with in the AI space. The reason for this is simple. Apple can bring AI to the consumer’s pocket by the billions, and is rumored to be sitting on one of the best AI models on the market today, with comparable performance to OpenAI’s ChatGPT.

Two Billion Devices to Lever AI

Apple’s installed active device base surpassed 2 billion last February and “reached an all-time high in every geographic segment” at the end of the June quarter, according to CFO Luca Maestri. The iPhone’s installed base also “grew to a new all-time high,” and is estimated to have nearly 1.5 billion active devices worldwide, after adding around 500 million active devices since 2019—an 11.4% compound annual growth rate since then.

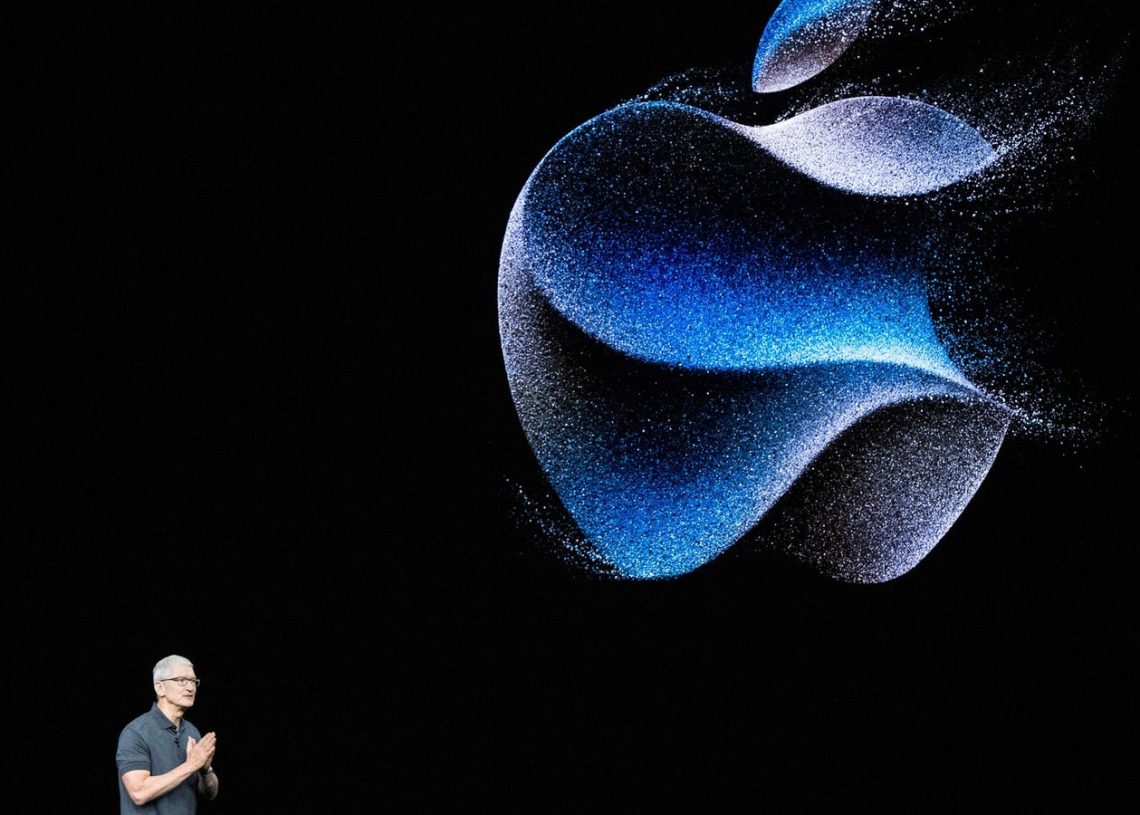

While installed active devices reached a new record, so did Apple’s subscriber base. CEO Tim Cook noted during Apple’s FQ3 report in August that the company hit an “all-time revenue record in Services” with “over 1 billion paid subscriptions,” which are growing at a double-digit rate. Apple has added more than 65 million subscribers in the first half of this fiscal year and more than 300 million subscribers over the past two fiscal years heading into its fiscal Q4.

The opportunity for Apple to capitalize on AI arises from the combination of growth within Apple’s installed device base, along with increased engagement and adoption of paid subscriptions over time. Consumer interest in AI surged earlier in 2023 with ChatGPT garnering over 100 million active users and more than 1 billion visits monthly. Apple’s installed base offers the chance to more than 10 times the number of individuals with readily available access to AI.

Services Is Where AI Can Shine

Apple is witnessing a higher contribution from its services segment to both revenues and margins—the segment is approaching a $100 billion annual run rate, accounting for nearly 26% of revenue with a 70.5% gross margin.

In other words, services is contributing 41.1 cents to each dollar of gross profit, up from 34.6 cents just eight quarters ago. The segment has seen its contribution to gross profit increase steadily, rising 46% from 23.7 cents per dollar in FY18 to 34.6 cents per dollar to date in FY23. It is not out of the picture for services to soon contribute 50 cents of each dollar of gross profit as the segment surpasses $100 billion in annual revenue.

The importance of services to Apple’s bottom line cannot be overstated—that 70% gross margin level combined with its nearly $100 billion revenue scale has pulled Apple’s margins higher over the past few years and will likely continue to do so in the future as transacting accounts and paid accounts continue to grow to new all-time highs.

This is exactly where AI will have the most profound impact on Apple, and why the tech giant could emerge as a strong AI contender.

Google and Microsoft demonstrate the revenue potential of AI subscriptions at scale—for Microsoft’s Copilot, a 2.5% take rate of the ~382 million commercial Office 365 users would equate to nearly $3.5 billion in annual revenue, while a 10% take rate would see annual revenue reaching $14 billion, according to Macquarie.

In Apple’s case, it has nearly three times the paid subscription base as Microsoft that it could target with an AI product, via a stand-alone service or in one of its three pre-existing service bundles. Regardless of the route that Apple chooses, there remains billions in revenue potential. Offering a stand-alone AI subscription for $2.99 per month could rake in ~$10.8 billion in annual revenue at a 15% attach rate based on Apple’s more than 2 billion active devices, while boosting the prices of its subscription bundles could by $0.50 per month could add more than $5 billion annually.

Apple Can Bridge the Gap with Mass-Market Consumer AI

Apple is spending millions of dollars per day in a quest to develop a conversational AI model, potentially for Siri, that would allow iPhone and iPad owners to use voice commands for automating multi-step tasks with the voice assistant. As such, Apple is uniquely positioned to both monetize and implement advanced AI in a mass-market consumer application.

Consumers, especially Millennials, are very willing to adopt and pay for such voice assistants that are as smart and as reliable as a human. According to a PYMNTS survey from April, more than 42% are willing to pay $10 or more per month for an assistant.

Although Apple is tight-lipped about the progress of its AI projects, the so-called Apple GPT chatbot is rumored to be more powerful than Open AI’s GPT 3.5 model, according to The Verge. Apple is spending millions of dollars a day training the large language model Ajax on more than 200 billion parameters.

The project could find life integrated within Siri, given the applications within automating multiple tasks and range of capabilities stemming from image and video recognition.

Apple noted back in 2020 that Siri had more than 25 billion requests made per month, a figure that could easily be increased with a ChatGPT-like chatbot installed across billions of devices. That is how Apple can be the first big stock in consumer driven AI uptake.

On Real Vision, I previously pointed out that “if you take a consumer-facing company like Google,” that they are in a good position because Google doesn’t “have to go out and try to get lots of consumers to adopt something new, consumers will continue to use Search, it’ll just be improved Search; advertisers will continue to use Google, it’ll just be improved ROI.”

For Apple, it’s the same case – it does not have to try to convert millions of users into a paid subscriber in the way that OpenAI does; rather, it could easily integrate an advanced conversational AI model within Siri for example, and quickly convert already-paying subscribers over to those AI services.

Damien Robbins, Equity Analyst at the I/O Fund, contributed to this article

The I/O Fund was early to AI with a 45% allocation in 2023. For more in-depth research from Beth, including 15-page+ deep dives on the 10 stock positions the I/O Fund owns, subscribe here.

Disclosure: The I/O Fund does not own Apple at this time and has no plans to buy in the next 72 hours, rather the I/O Fund is tracking the stock for a lower entry. If you want to hear more on the best timing to buy AI stocks, join I/O Fund next Thursday, October 19th at 4:30 pm EST, for our premium webinar. We will go over the specific AI stocks we are targeting for this final run higher, as well as our game plan for when we confirm a top in equities. Learn more here.

If you would like notifications when my new articles are published, please hit the button below to “Follow” me.

Read the full article here