With mortgage rates expected to drift toward 6% in the coming year, 10 U.S. markets could see a major boost as buyers regain purchasing power.

The National Association of Realtors (NAR) recently looked at 10 key indicators, including how lower rates affect buying power, how well home prices match local incomes, migration trends and job growth to find where “home sales will likely be liveliest in the coming year.”

To make the list, each area needed a population over 250,000, stronger performance than the U.S. on at least five indicators and clear opportunities for buyers and Realtors, according to the report.

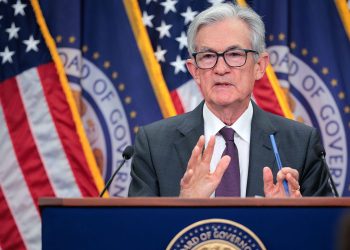

FED CUTS INTEREST RATES FOR THIRD STRAIGHT TIME AMID UNCERTAINTY OVER LABOR MARKET, INFLATION

The top 10 home buying hot spots include:

Charleston, South Carolina

Charleston’s inventory is rising in the $200,000–$350,000 range, and more than 20,000 additional households would qualify for a median-priced home with rates at 6%.

Millennials make up 36% of local households, and the area has strong job and income growth, according to NAR.

“Charleston has a large pool of renters who are just at the edge of affordability,” the report noted. “A shift from 7% to 6% significantly expands the number of local households who qualify for the median home.”

Charlotte, North Carolina

Over 52,000 more households would qualify for a median-priced home at a 6% mortgage rate. The metro has a strong migration inflow, income gains, job growth and high millennial concentration.

“Charlotte’s winning formula in 2026 is simple: young buyers, strong jobs, and more listings where people need them,” the report noted.

Columbus, Ohio

More than 41,000 additional households would qualify at a 6% mortgage rate. Millennials make up 37.5% of the area, incomes are up compared to the prior year and job growth is strong, according to the report.

“Columbus continues to outperform expectations as one of the Midwest’s most resilient and stable housing markets. Income growth remains stronger than the U.S. average, and investments — including logistics expansions — are bringing high-quality jobs that support long-term housing demand,” NAR noted.

RYAN SERHANT SAYS HIS DAUGHTER WILL HAVE TO ‘FIGURE IT OUT’ AS HOUSING MARKET RESETS FOR GEN Z

Indianapolis, Indiana

Indianapolis is one of the “most balanced and opportunity-rich markets heading into 2026,” according to NAR.

More than 42,700 additional households would qualify at a 6% rate, and the area has a strong millennial presence, solid job gains and a strong match between home prices and local incomes.

Jacksonville, Florida

“Jacksonville is one of the Florida markets where both affordability and inventory are improving at the same time,” NAR noted.

More than 39,700 additional households qualify for a median-priced home at a 6% rate. The area also has strong income growth and rising migration.

Minneapolis–St. Paul, Minnesota

The Twin Cities gain more than 81,000 newly qualified households with rates at 6%.

More homes in the $250,000–$450,000 range are returning to the market, and the area shows strong job growth, a high concentration of millennial households and stronger alignment between prices and incomes.

“Minneapolis is one of the nation’s most responsive markets to lower rates — and 2026 will show it,” NAR noted.

Raleigh, North Carolina

Nearly 27,000 more households qualify with lower rates.

Raleigh has strong income growth, a high millennial population, solid job gains and a stronger match between incomes and home prices.

“Raleigh’s combination of fast-growing incomes and better-aligned inventory makes it one of the clearest opportunity markets of 2026,” NAR noted.

ICONIC HOLLYWOOD HILLS HOME HITS MARKET FOR FIRST TIME EVER WITH $25M ASKING PRICE

Richmond, Virginia

More than 25,500 additional households qualify for a median-priced home with mortgage rates at 6%.

One of the “most quietly powerful opportunity markets in 2026,” Richmond has strong job gains, fewer price cuts than the national average, a stronger match between home prices and incomes and a strong millennial presence.

“Richmond’s strength lies in its stability — and in 2026, that stability becomes opportunity,” the report noted.

Salt Lake City, Utah

About 25,000 additional households could afford a median-priced home at 6%.

Salt Lake City has a strong millennial presence, strong income growth, solid job gains and listings increasingly align with local incomes.

“Salt Lake City’s youthful demographics and improving inventory make it one of the biggest beneficiaries of lower rates in 2026,” NAR noted. “Listings aligned with incomes surged 20.7% year-over-year, making it one of the biggest affordability rebound markets.”

Spokane, Washington

“Spokane is one of the few Western metros where both affordability and inventory are trending in the right direction,” the report noted.

Over 9,500 additional households in Spokane qualify for a median-priced home with mortgage rates at 6%. The market also has strong income growth, high millennial concentration and fewer price cuts than the national average.

Mortgage rates inched up this past Thursday as markets reacted to the Federal Reserve’s decision to cut its benchmark interest rate for the third straight time, according to Realtor.com.

The average 30-year fixed mortgage rate climbed to 6.22% for the week ending Dec. 11, up from 6.19% the previous week, according to Freddie Mac. A year earlier, rates averaged 6.60%.

Read the full article here