Federal Reserve Chair Jerome Powell said at a conference Friday that President Donald Trump’s tariffs are likely to increase inflation and slow economic growth, saying the central bank will do what it can to keep long-term inflation low.

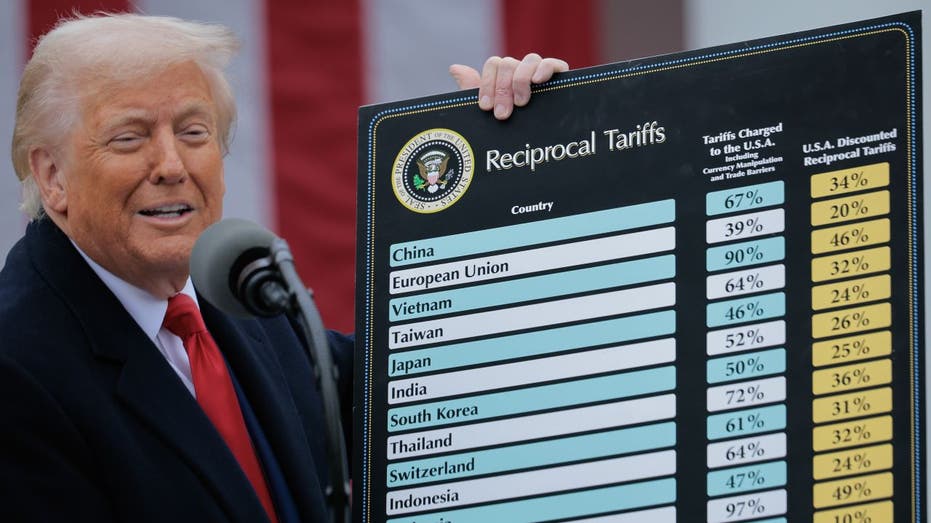

President Trump unveiled sweeping tariff plans on Wednesday that prompted a stock market sell-off and which have prompted retaliation from U.S. trading partners. The S&P 500 is down about 4% on Friday and more than 6% over the past five trading days, while the Dow Jones Industrial Average entered correction territory, down over 10% from its record high in December.

Powell said in his remarks at Friday’s conference that it’s difficult to predict the impact of tariffs on inflation and other economic indicators “until there is greater certainty about the details, such as what will be tariffed, at what level, and for what duration, and the extent of any retaliation from our trading partners.”

“While uncertainty remains elevated, it is now becoming clear that tariff increases will be significantly larger than expected, and the same is likely to be true of the economic effects, which will include higher inflation and slower growth,” he explained. “The size and duration of these effects remains uncertain.”

CHINA RETALIATES WITH 34% TARIFFS ON US IMPORTS

Powell sad that while “tariffs are highly likely to generate at least a temporary rise in inflation, it’s also possible that the effects could be more persistent.”

“Avoiding that outcome would depend on keeping longer-term inflation expectations well-anchored on the size of the effects and how long it takes for them to pass through fully to prices,” he said. “Our obligation is to keep longer-term inflation expectations anchored, and to make sure a one-time increase in the price level does not become an ongoing inflation problem.”

Inflation has remained stubbornly above the Fed’s 2% target rate, with the most recent consumer price index (CPI) data coming in at 2.8% for February and the central bank’s preferred metric, the personal consumption expenditures (PCE) index, at 2.5%.

TRUMP CALLS FOR FED’S POWELL TO CUT INTEREST RATES AND ‘STOP PLAYING POLITICS’

Powell was asked during a question-and-answer session that followed his speech at the Society for Advancing Business Editing and Writing Annual Conference in Virginia about the Fed’s role at a time of turbulence in financial markets and economic uncertainty stemming from political policies.

“We’re driven by analysis and careful thought and discussion and debate, and the merits of things. We try to stay as far as we can from the political process, we don’t look at political cycles or things like that,” Powell said.

WHAT IS THE TIME FRAME FOR TRUMP’S TARIFFS TO LEAD TO PRICE INCREASES?

“We don’t want to be part of the broader discussion about the wisdom of policies that are not assigned to us. We’re not responsible for trade policy, immigration policy, fiscal policy,” he said. “So, we don’t comment, those decisions are made by others, and what we do is use our tools to try to achieve the goals that Congress assigned us, which is maximum employment and price stability.”

“I like to think that over time, we are a source of calm, rational analysis and also of stability,” Powell added. “The business that we’re in is providing financial and macroeconomic stability to the public, that’s really our purpose.”

The Fed’s next policy meeting is in May, and Powell said that in terms of the central bank cutting interest rates, “It feels like we don’t need to be in a hurry.”

Read the full article here