Student loan borrowers in the U.S. are taking their time resuming repayments after the last pandemic-related pause expired late last year.

Repayments were paused for borrowers of federal student loans from mid-March 2020, when the COVID pandemic began, and remained in effect until Sept. 1, 2023, 3½ years after the repayment pause began.

Data from the Department of Education shows that, as of the end of March of this year, almost 20 million borrowers have resumed making payments on their student loans, while roughly 19 million haven’t done so, leaving their accounts in a state of delinquency, default or otherwise paused through deferment or forbearance, The New York Times reported.

Borrowers have until September to take advantage of a so-called on-ramp that allows them to hold off on making payments without having the non-payments reported to credit bureaus. However, their accounts continue to accrue additional interest while the on-ramp is in effect.

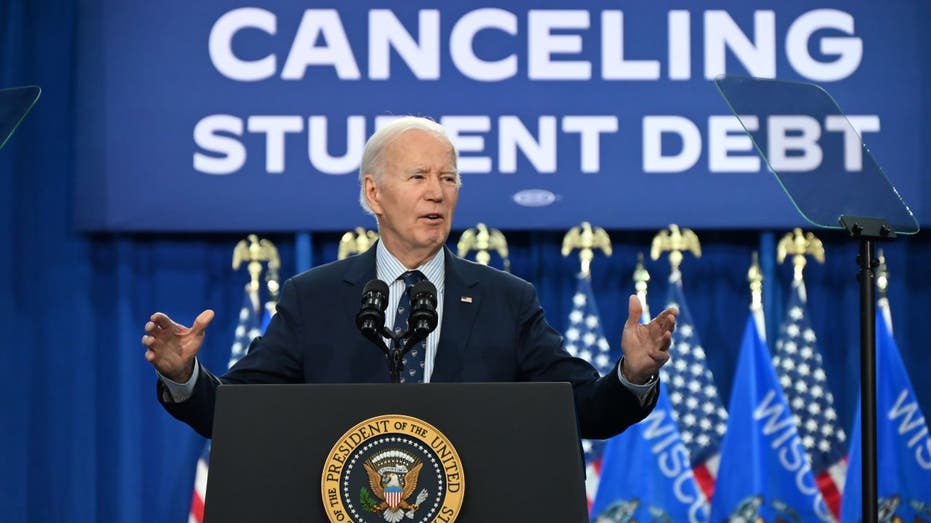

BIDEN’S STUDENT DEBT HANDOUT PLAN COULD COST AS MUCH AS $1.4 TRILLION

The data showed that 42.8 million recipients of federal student loans owed a total of $1.62 trillion in debt as of the end of March.

The number of recipients declined to its lowest level since the third quarter of 2022 amid President Biden’s student loan handout plans that have sought to cancel or reduce outstanding balances for borrowers.

Several iterations of Biden’s student loan debt cancelation plans have been rejected or put on hold by federal courts, prompting the administration to explore different ways to approach the issue that may pass legal muster.

GEN X, BOOMERS AMONG STUDENT LOAN BORROWERS WHO OWE THE MOST: REPORT

The Biden administration’s new income-driven repayment (IDR) program, known as the Saving on a Valuable Education (SAVE) Plan, was the latest version to encounter legal headwinds.

Last week, a federal court in Missouri barred the Biden administration from granting additional forgiveness to borrowers under the SAVE Plan.

A federal judge in Kansas also found that the SAVE Plan was unlawful last week, though that ruling was put on hold by a federal appellate court Tuesday, allowing the Education Department to continue cutting payments under the plan.

Announced in 2023, the SAVE Plan modified and replaced the prior IDR plan called the REPAYE Plan. Under the SAVE Plan, borrowers’ monthly payments are calculated based on their income and family size. It lowers payments for nearly all borrowers, while granting forgiveness to borrowers who originally took out $12,000 or less in loans after 10 years.

It also includes an interest benefit for borrowers who make their full monthly payment, but the amount isn’t enough to cover their monthly accrued interest. The federal government pays for the remainder of the accrued interest that month under the plan. So, in effect, this provision prevents balances from growing due to unpaid interest.

Read the full article here