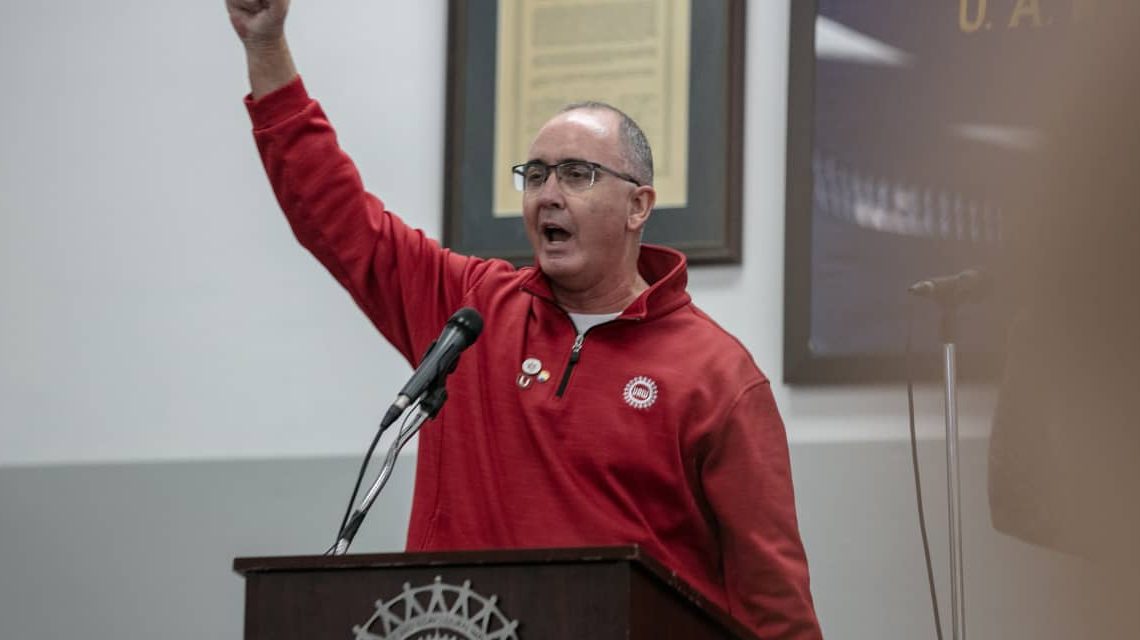

United Auto Workers President Shawn Fain announced Friday that the strike against the Detroit Three auto makers wouldn’t be expanded. But that doesn’t mean negotiations are over—not by a long shot.

The longer any strike lasts, the larger the problem it becomes for the companies involved. But a long strike will become a problem for the union, too.

After a wild week that included a surprise walkout at a key Ford Motor (ticker: F) assembly plant, Wall Street is eager for clues about how and when the strike might end. They didn’t get much from Fain’s update today. Instead, investors were told more uncertainty was on the way.

“We’re not waiting until Fridays to escalate our strike,” said Fain. “Our fight’s not just about us, it’s about the working class.”

The union’s strike against Ford,

General Motors

(GM), and

Stellantis

(STLA) has been unlike any other. Workers are striking all three companies at once rather than targeting one at a time as it has done in the past. The strategy, which Fain calls a “stand-up strike,” has succeeded in creating confusion, chaos, and financial pain for the auto makers.

“It’s [been] a different approach,” Edward Jones analyst Jeff Windau said of the UAW strike strategy. “Inflicting maximum pain concerns me. These companies need to be competitive in their markets. There has to be a [drive] to come to a contract.”

The strike started on Sept. 15 in a limited way with some 12,000 workers walking out at three plants. The strike was expanded twice; announcements of new strike targets were delivered on Fridays.

That pattern changed on Wednesday evening when the UAW walked out of Ford’s huge Kentucky Truck Plant. It makes super-duty trucks and generates about $25 billion in revenue a year. Fain said that works out to $48,000 a minute, and said many members don’t make that much in a year.

He’s probably understating the case. The plant doesn’t run 24-7. The revenue per operating minute is likely closer to $80,000.

That said, revenue isn’t a metric that should matter in labor discussions. Owners and labor are fighting over profits.

Fain, for his part, has won wage concessions, inflation protection, better retirement benefits, fewer worker classes, and the right to treat some new battery workers like all other UAW employees. But Fain’s rhetoric might be reaching its limit, evidenced by his talk of revenue.

Ford, after all, has said it has reached its limit. To that, Fain responded by saying CEO Jim Farley made $20 million in total 2022 compensation. Barron’s looked at CEO pay among the three auto makers. They are paid more than peers. But if the CEOs agreed to work for nothing, the leftover funds would amount to roughly $100 per employee per year.

Overpaid? Maybe. But CEO givebacks won’t solve this strike.

“We see [the Kentucky] move from the UAW as concerning given that Ford gave the largest concessions to the union among the Detroit-Three,” wrote BofA Securities analyst John Murphy in a Thursday report. “It is possible, however, that since Ford has been the most accommodating, the UAW might believe it can obtain additional concessions by increasing the pressure.”

In the current chess match, Fain has dominated the opening and middle games, but he needs an endgame to do the best for the membership. The UAW declined to comment about its strategy.

Fain might want to be careful in stirring up too much ire or raising expectations too high among UAW members. UAW workers at Mack Trucks recently rejected a tentative agreement, with 73% of the membership voting no. Mack UAW employees appear to be convinced they can get more.

“I didn’t raise [worker] expectations,” said Fain referencing the Mack strike. “Our broken economy raised expectations.”

“You have to generate money to invest in your business,” added Windau. “There is some middle ground there…if you cut to the bone there is nothing to invest.”

Currently, about 33,000 UAW workers are on strike and another 5,000 have been laid off because production has been disrupted. Those 38,000 people amount to a bit more than one-fourth of the 145,000 UAW members employed by the Big Three.

There is no indication that the strike is close to ending, either. “The longer the strike goes on, the more the public is with us,” said Fain. Indeed, there is overwhelming public support for the strike at the moment. However, it isn’t a given that support stays strong.

BofA’s Murphy rates Ford stock at Buy with a target of $23, nearly double the shares’ Thursday closing level of $12. Edward Jones’ Windau rates Ford and GM shares Hold, meaning he expects the stocks to perform in line with the market. He doesn’t have price targets.

The negotiations are weighing on shares of Ford and GM. Through Friday trading, Ford and GM stocks were down about 21% and 27%, respectively, over the past three months, while the

S&P 500

was down about 4%.

Stellantis shares are up about 4%, but the auto maker is a more global company and its shares are cheaper than the other two stocks. Stellantis stock trades for less than four times estimated 2024 earnings. Ford and GM shares trade for less than seven and five times, respectively.

The big winner from the strike looks to be

Toyota Motor

(TM). None of its U.S.-based workers are on strike. Its shares are up about 11% over the past three months.

Ford stock dropped 1.6% Friday, GM stock dropped 2.2%, and Stellantis shares fell 0.5%, while the S&P 500 ended 0.5% lower, and the

Dow Jones Industrial Average

closed up 0.1%

Write to Al Root at [email protected]

Read the full article here