It didn’t take long after the IRS announced an additional delay in enforcing the new $600 reporting threshold for Forms 1099-K (more here) to garner reactions across the country.

National Taxpayer Advocate Erin Collins issued the following statement: The IRS’s decision to delay implementation of the new Form 1099-K reporting requirements is good news for taxpayers, tax professionals, and payment processors. Equally important is the IRS’s announcement today that it will adopt a phased-in approach and only require reporting of transactions totaling more than $5,000 next year. Taxpayers and tax professionals need certainty and clarity about what is expected of them. By announcing its plans for this year and next year now, the IRS is taking steps to provide it. For the sake of clarity, however, it’s important for taxpayers to understand that today’s announcement applies only to reporting requirements imposed on third parties. If income is taxable, taxpayers have been and continue to be required to report it on their tax returns. Nothing about the Form 1099-K reporting dates changes that.

The Taxpayer Advocate is the “Voice of the Taxpayer” within the IRS and before Congress. The Taxpayer Advocate Service advocates for resolution of individual and business taxpayer issues within the IRS.

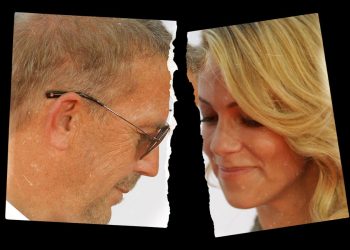

National Taxpayers Union Foundation Executive Vice President Joe Bishop-Henchman said in a statement: ARPA’s threshold was originally supposed to have gone into effect for tax year 2022 but was delayed because of compliance and administrative concerns. All of the problems and concerns that led the IRS to delay implementing it a year ago remain in place today, which is why it is a relief for taxpayers that it has been delayed for another year… While the threshold change was a law passed by Congress, every expert (including those charged with administering it) is saying that lowered threshold is unworkable. Hopefully it is revisited.

Congress needs to take advantage of the IRS’s new delay to fix this issue once and for all. The $600 threshold is unworkable and must be changed legislatively. Multiple bipartisan bills have been introduced in Congress, including ones from House Ways and Means Chair Jason Smith, Sen. Maggie Hassan, and Sens. Sherrod Brown and Bill Cassidy. It’s imperative that Congress makes a policy fix so that taxpayers are not beset by yet another year of confusion and with a paperwork deluge hanging over their heads.

The NTUF is a taxpayer advocacy organization and taxpayers union.

The Coalition for 1099-K Fairness also issued a statement, from Arshi Siddiqui, a partner at Akin Gump, who is leading the Coalition’s lobbying efforts: The IRS decision to delay 1099-K implementation spares millions of Americans from widespread confusion and represents a critical step in allowing Congress more time to craft a legislative solution. The Biden Administration’s decision represents a victory for common-sense tax policy by ensuring that consumers are not facing a tsunami of 1099-Ks in January. Congressional Members across the ideological spectrum are working towards a permanent, bipartisan fix and we look forward to working with them to provide certainty for millions of Americans.

The Coalition is comprised of 20 diverse online marketplaces and payment processors, including Airbnb, Bikelist, Block, Inc. (formerly Square, Inc.), eBay, the Electronic Transactions Association, Etsy, Eventbrite, Goldin, Mercari, Noihsaf Bazaar, OfferUp, PayPal, Kidizen, Poshmark, Reverb, Rover, the Sports Fan Coalition, Stubhub, TechNet, and Tradesy.

U.S. Senator Sherrod Brown (D-OH), also commented: Today the IRS finally agreed to delay its burdensome requirements on Ohio small businesses and online entrepreneurs. This is welcome news for small businesses across Ohio who were about to be hit by red tape and excessive paperwork. But it’s not enough. It’s time to eliminate the $600 reporting threshold and permanently protect Ohioans from excessive IRS paperwork by passing my bipartisan Red Tape Reduction Act.

Brown is a senior member of the Senate Finance Committee. Earlier this year, Brown, alongside U.S. Senator Bill Cassidy (R-LA), led the introduction of the Red Tape Reduction Act, legislation that will raise the threshold to $10,000 from $600, ensuring that fewer small businesses and entrepreneurs receive excessive paperwork for online sales.

—

Check back with our Forbes tax team for more updates.

Read the full article here